Shorter vesting schedules: winners and losers

Our flash poll for large enterprise tech companies revealed that 25% of participants are considering shorter vesting schedules.

I doubt that many will make the change. But it illustrates the shareholder pressure right now to reduce burn.

With shorter vesting schedules, the shareholders would win. What about employees? Management?

Before we dig into it — are you implementing a shorter vesting schedule?

Let’s set the stage by thinking through program design, then walk through impact for each stakeholder.

Program design

Assume we’re going from a standard 4-year vest to a 1-year vest (radical!).

Our stock price is $20 and the standard program targets $100k/year vest.

The first obvious question is, are we using stock for a short-term incentive program now? That’s a philosophical (and accounting) matter worth digging into…

But the second question would be, how much do we give back to shareholders and how much to employees?

If a 4-year program targets $100k in annual vests with refreshes, it eventually stacks to $400k per year. If a 1-year program targets the same annual vest, we give all the overhang back to shareholders, and the employee eventually gets only 25% of the value.

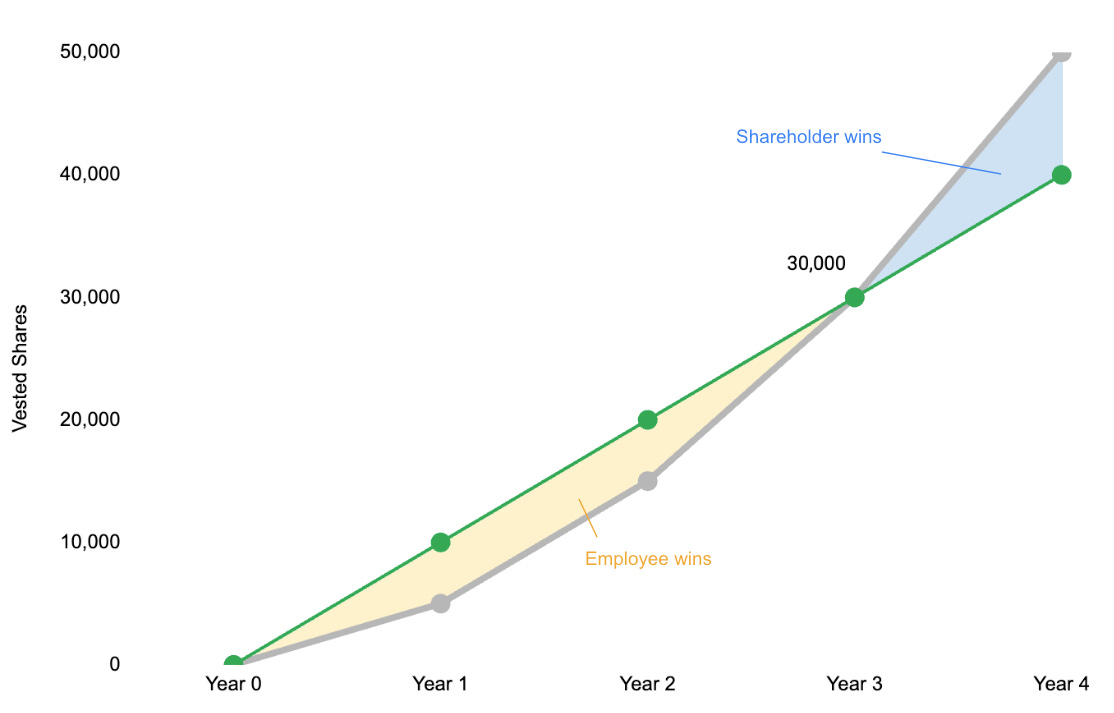

All else equal, you can model out the break-evens in vested value:

For purposes of program design, let’s keep things even and split the benefit between shareholders and employees: breakeven in Year 3 (green line), spending half the shares.

So let’s summarize our program changes:

Old program:

4-year vest with annual refreshes

$400k per grant

$100k vesting annually, stacking up to $400k/year in Year 4

New program:

1-year vest with annual refreshes

$200k per grant

$200k vesting annually, no stacking

Now — which program is better for who?

Shareholders: winners

Our new program spends 40,000 shares in years 0-3, compared to 80,000 shares in the old program; shareholders are big winners.

Note, however, that this win relies on a key assumption: average employee tenure.

The new program vests shares faster because growth is linear. Since we set our breakeven at Year 3, if average employee tenure is less than 3 years, our new program is actually more expensive because more value vests upfront.

Note too that this tradeoff is sensitive to stock performance.

When stock appreciates, the shareholder benefit grows because the employee has less unvested value participating in the upside

When stock depreciates, the shareholder benefit shrinks because the employee has less unvested value participating in the downside

As a shareholder, I’ll take a 50% reduction in gross share spend and roll the dice on longer tenure and growing share price.

Shareholders win.

Management: losers

Our new 1-year vest program has three big operational risks:

Attrition risk: those golden handcuffs aren’t so golden now

Quality of hire risk: it’s an eye-catching program for risk-averse talent

Performance risk: less long-term upside drives shorter-term decisions

#2 and #3 are harder to quantify. And presumably you could mitigate these risks with excellence in hiring and performance management, respectively.

But #1, attrition risk, is hard to get around.

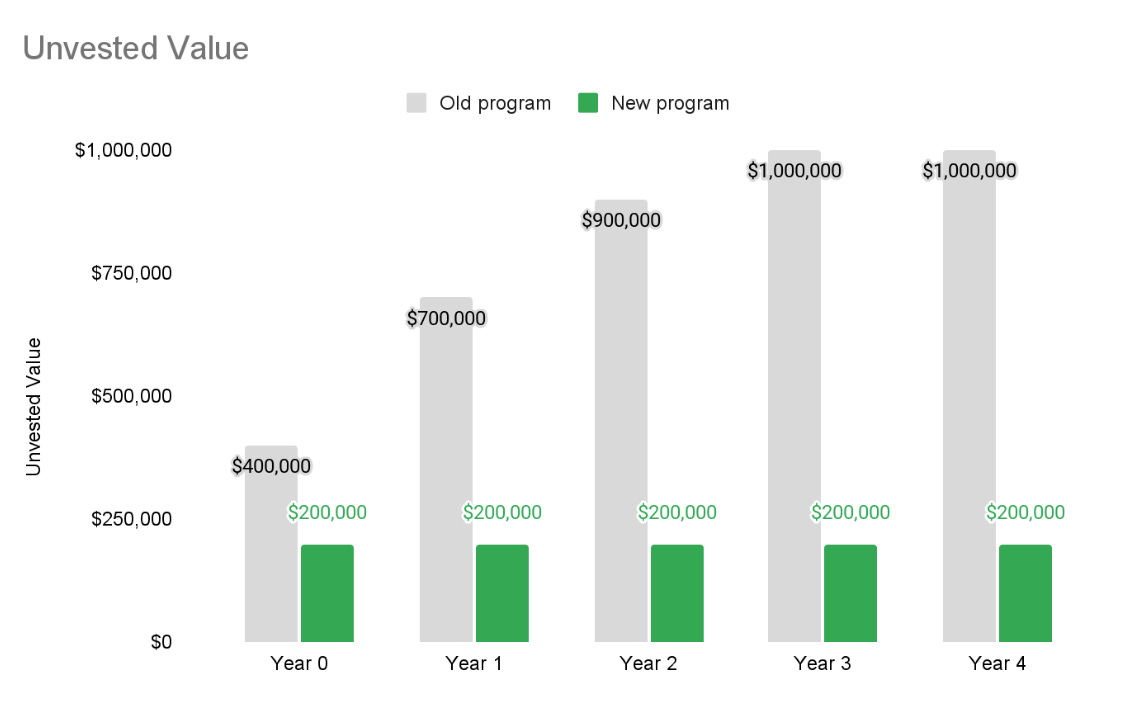

In the old program, unvested value starts out strong and grows to $1 million. But in the new program, unvested value stubbornly sits at $200k per year.

Admittedly, the attrition risk is particularly acute because we chose a 1-year vest program. If instead you changed your program from 4-year vest to a 2- or 3-year vest, you’d still have bronze or silver handcuffs. The 1-year program hands the inmate the jail cell key.

As a manager, our new program made it way harder to retain my team.

Managers lose.

Employees: mixed

Our new 1-year vest program presents the classic tradeoff to employees: a bird in the hand versus two in the bush.

I think it just depends where you are in life.

I like the new 1-year program if:

I’m a recent college grad with $117k in student loans trying to make rent 👀

I got laid off from that hot startup that went public via a SPAC and I long for predictability

I bought my Palo Alto dream house with a 7.5% interest rate and need to settle my stomach

I like the old 4-year program if:

I have no expenses beyond my daily Philz, and I’m confident this company is my rocket ship to the moon

The kids are out of college and I’m ready to take on some risk again

I’m here for the benefits, anything the stock does is just goodness

Who are your employees today?

And if you implement the new program, who will they become?

For employees, it’s mixed.

Concluding thoughts

This is an amazing time to be in the comp world: all of these market shocks are forcing us to rethink the status quo, from vesting to remote work to pay-for-performance.

I believe the most innovative companies are experimenting with changes like shorter vesting schedules. I understand the culture of conservatism in comp, and the accountability to the board.

But now more than ever before, boards are rewarding smart, unconventional thinking, including ways to cut costs.

Good luck out there. And tell me what I missed!

Peer Group is a newsletter for comp leaders navigating the new era of pay transparency! If you want to share my newsletter, you can forward this email to your colleagues and fellow comp leaders.

Want more polls and insights about pay transparency?

Subscribe by hitting the button below.