How AI changes comp economics (Part 3)

The third and final post of a 3-part series exploring the economics of compensation management

Adoption of AI in compensation is inevitable.

Why? Economics.

Supporting comp decisions with AI agents is 90% lower cost than humans. That, in turn, unlocks new levels of coverage and precision to manage billions in pay each year.

Comp teams working alongside agents will be smarter and more productive. And I believe (per Parkinson’s Law’s induced demand) we will observe more expansion of impact than job displacement — there is simply too much ROI at stake.

In this post, the third and final in my 3-part series, I lay out the math — buckle up — to show why AI can’t be ignored.

And how AI will change compensation forever.

TL;DR on my first two posts

The economics of AI in compensation builds on the core concepts I laid out in my first two posts in this series:

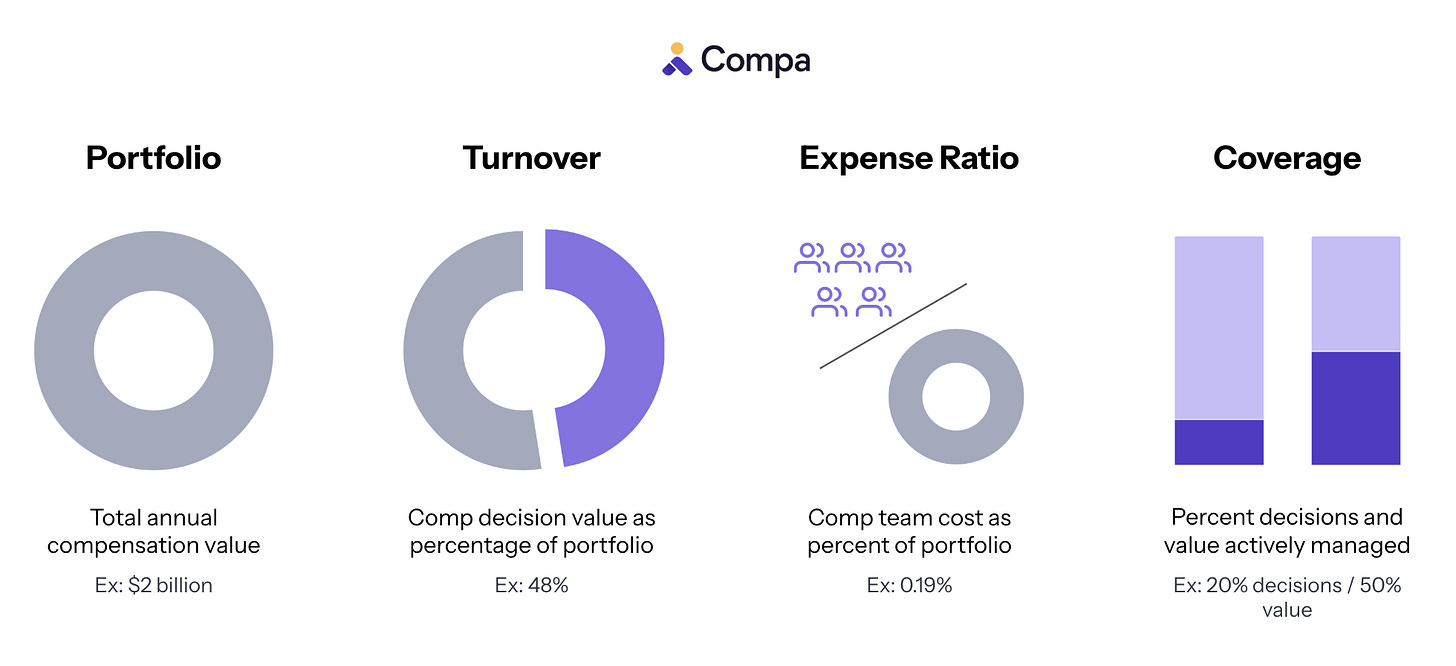

Comp portfolio size and turnover (Part 1)

Comp teams are like Wall Street firms managing billions in assets, their comp portfolio

The comp portfolio size is the value of all employee compensation each year

The comp turnover is the value of all the pay decisions we make each year

Comp team expense ratio (Part 2)

Comp turnover is high, requiring active management, more like a Wall Street mutual fund than a passively-managed index fund

The comp expense ratio is the size and cost of your comp team as a percentage of the total comp portfolio

Most comp teams rationally triage a small percentage of high-value decisions and passively managing the rest, resulting in a lower-than-expected expense ratio

Tech company example

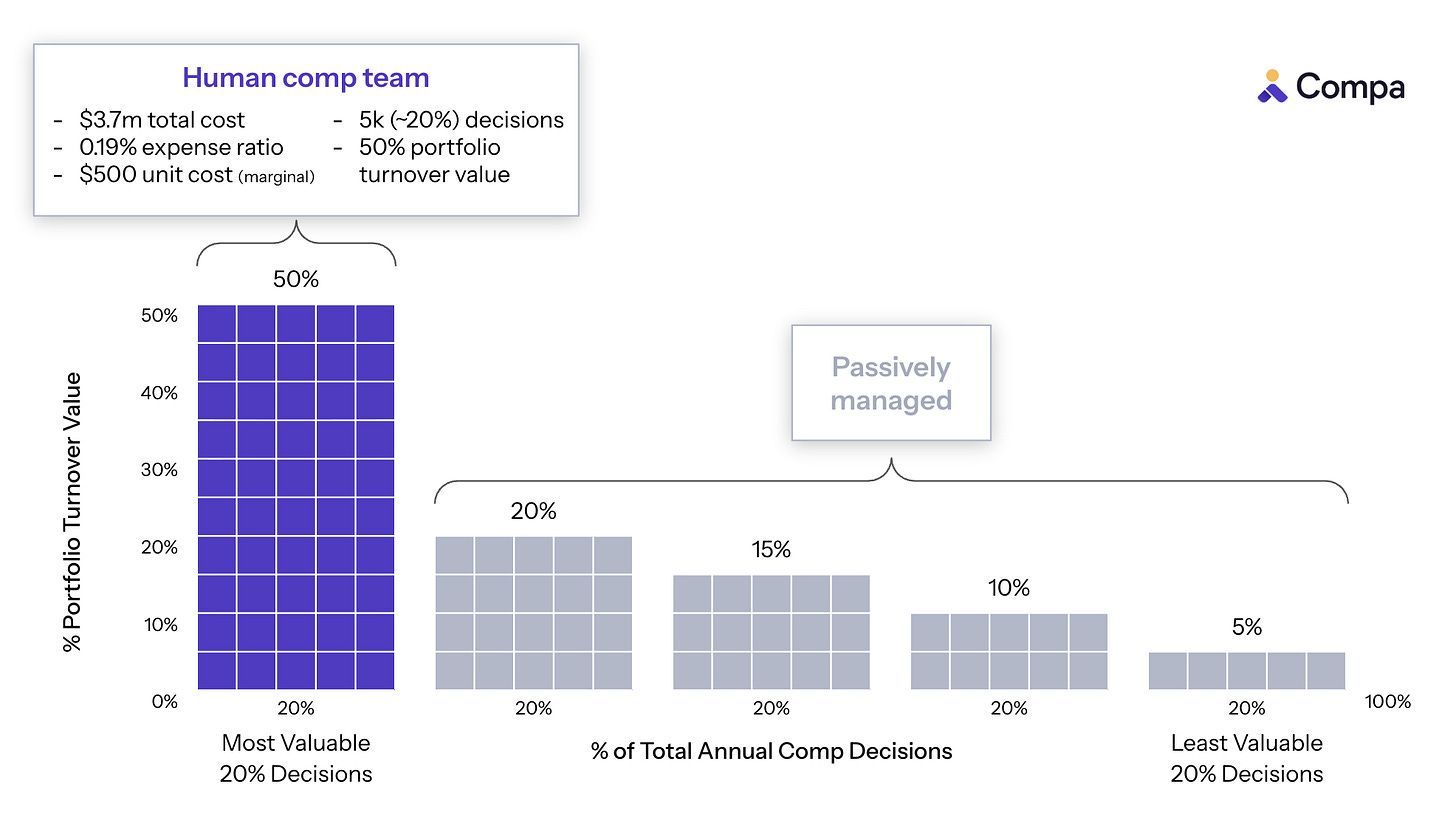

Putting these concepts together for an example 10,000-person tech company:

With an average TDC of $200,000, the comp portfolio is $2 billion

Offers, pay increases, bonus payouts, etc., are worth $950 million, for 48% turnover

The 10-person comp team that costs $3.7 million to manage the $2 billion portfolio has a 0.19% comp expense ratio

This team has the capacity to actively manage about 5k of its ~27k annual pay decisions covering half the portfolio value, leaving 22k decisions worth $1 billion passively managed

Agent unit costs

Let’s start by positioning agentic AI conservatively as a lower-cost alternative to humans. This understates its value because AI makes the humans way better - we’ll come back to that.

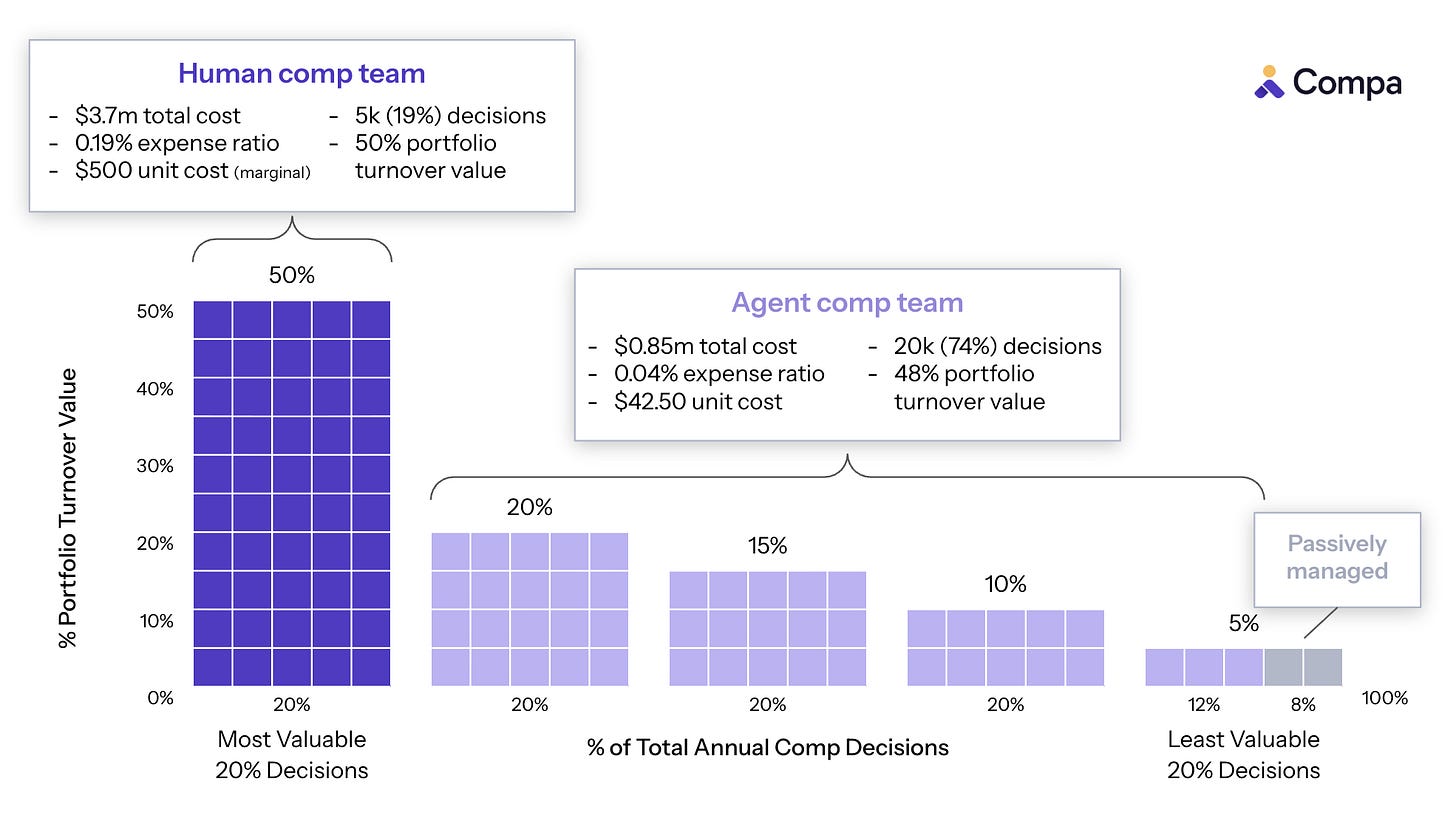

Human costs

We estimated that a human comp expert has capacity to actively manage 500 pay decisions per year based on a 10-person team focusing on the top 5,000 most valuable decisions.

At a fully loaded cost of $250,000, the human comp expert has a unit cost of $500 per decision.

$250,000 ÷ 5,000 decisions = $500 / decisionYes, of course we could try to find lower-cost people — more junior, different geos, etc. But notice the cost is still high even on the low end: a $60,000 comp analyst in India still carries a $120 unit cost, and that’s assuming decision capacity is just as high.

Adding in management and discretionary costs, we’re spending $3.7 million to manage ~20% of our decisions worth 50% of our portfolio turnover value. The rest are passively managed, meaning comp people don’t review them.

Agent costs are 90% lower

An agent, on the other hand, can manage thousands of decisions simultaneously.

While an AI agent is technically unconstrained, we should characterize the agent as contextually constrained. That is, we may deploy multiple agents focused on different areas, like different people on the comp team*:

Comp partnering domains: R&D, GTM, and G&A

Geographic or business units: AMER, EMEA, APAC, LATAM

Pay decision types: offers, merit cycles, and retention

*How these agents are trained and deployed is critical to success, and was the topic of deep discussion at our most recent agents product workshop; but it is beyond the scope of today’s post.

Let’s assume we train and deploy five comp agents, and each costs $150,000/year, plus $100,000/year in a person’s time to manage them, for a total of $850,000 spend at our company.

What can these agents accomplish, and is it worth it?

In our example company, we have 22,000 decisions and $475 million in portfolio turnover value passively managed by the human team.

With our new team of five agents, we can actively support 90% of the long-tail decisions (some will always be made without comp looking).

That’s 20,000 decisions supported by $850,000 in agent spend, for a unit cost of only $42.50 per decision, compared to $500 per decision for humans.

Agent unit costs are 90% lower than people.

New technologies are economically disruptive when they fundamentally change unit costs. Agentic AI lowers the cost of compensation analysis by an order of magnitude.

With AI, a comp team can radically expand its reach to nearly every pay decision in the company with rational unit costs, unlocking tens of millions in ROI for the first time.

Agent ROI

Our $850,000 agents investment dramatically expands comp team coverage, and the incremental spend grows our annual comp team costs to $4.6 million, a 0.23% expense ratio of the $2 billion portfolio — still inexpensive compared to mutual fund fees.

Great, the math works. So what do we get in return?

Well… what do you get when a comp expert supports a pay decision?

The answer is smarter outcomes, which is to say, achievement of your compensation goals.

These goals vary over time and across the business. Sometimes we’re explicitly reducing cost. We are stewards of our company’s largest line-item investment, after all.

But usually cost reductions are balanced with increased competitiveness — spend less here so we can spend more there to get the best talent. Or we’re moving comp to manage the P&L, from cash to equity, or to manage performance, from fixed to at-risk.

Ultimately, the objective of a comp expert supporting pay decisions is to optimize your portfolio investment to achieve your goals.

The math

Let’s make a modest assumption that when a comp expert analyzes a comp decision, they make it 3% smarter. It’s not that much, on the margin:

A salary of $200,000 moves $6,000

A sign-on bonus of $30,000 moves $900

A starting hourly wage of $23.80 moves $0.72

In our example company with a $2 billion portfolio and $950 million in turnover, the comp team can generate $29 million in value each year. That’s a lot.

Our new agents team actively manages 48% of portfolio turnover value, or $456 million, for the first time. 3% smarter is $13.7 million in value, and the agents cost $850k.

Our agents investment yields an ROI of 16.1x.

But every comp team needs to run its own math based on its own goals and assumptions.

How much of that value is genuine, make-your-CFO-happy reduction in cost, versus “smarter” fluff?

Can you really address 20,000 pay decisions with agents, or do you start with a pilot of one agent to take on 3,000?

Can agents make decisions only 3% smarter? Can some areas like stock comp get 15% smarter?

This leads us to the natural question all of us should be asking — is this too good to be true?

AI in comp is inevitable… if it works

History doesn’t repeat itself, but it often rhymes.

— Mark Twain

If agentic AI works, the unit economics are too good not to adopt agents.

Every comp team with a portfolio of more than, say, $100 million, can achieve a massive efficiency gain in how agents support smarter pay decisions.

But will agentic AI work?

While undoubtedly some amount of the promise of agents is overhyped, we should have every reason to believe the technology will rapidly progress — look how much it’s already changed in the two years since ChatGPT arrived.

And companies like Compa are speeding through learning cycles to make agents smarter comp analysts that understand more and more scenarios.

Betting against AI feels like betting against the early digital cameras with grainy, pixelated images. Or against the first iPhone with no app store.

It’s a failure of imagination, both for anticipating the inevitable, but also for getting excited about what it makes possible in compensation for the first time.

Peer Group is a newsletter for comp leaders navigating competitive talent markets and AI transformation! If you want to share my newsletter, you can forward this email to your colleagues and fellow comp leaders.

Want more polls and insights about the latest thinking in comp?

Subscribe by hitting the button below.

Great math behind the article! Small note: it seems the 250k by 5,000 step may mix up per-person vs. team totals - the result is correct, 500 usd per decision, but a short clarification could make it clearer.