Coal versus wind

Tradeoffs with real-time market data are like balancing renewable energy sources

Comp surveys are coal plants.

Real-time data is wind power.

Comparing comp data to energy sources can help us understand how total rewards teams are using market data, and what to expect in this transitional era.

Join me in pulling the thread on this surprisingly instructive, if protracted, metaphor.

Base load versus peak load

Base load is always-on power, no matter the time of day. Energy sources like coal and nuclear are well-matched.

Think stability: hospitals and data centers.

Peak load spikes with usage at certain times of day. It’s easy to layer on wind power to meet surging demand.

Think flexibility: toasters and Netflix.

Surveys play this base load role. They are stable and predictable, widely used as foundations for setting comp strategy.

Real-time data, on the other hand, is designed for peak loads; for volatility. When the market rapidly changes with hot jobs or cooling stock prices, you can see it instantly.

Extending the metaphor

The similarity in tradeoffs between energy sources and market data sources gets way deeper than that…

Coal feels reliable. Wind feels experimental.

Coal plants are big and old. Windmills are small and young.

Coal is dirty (messy data files). Wind is clean (always synced).

Coal infrastructure is aging. Wind technology is improving.

Coal is cheap in the short run. Wind is cheap in the long run.

Coal has waning public support. Wind has growing public support.

Surveys are the past. Real-time data is the future.

But the shift will take time, and the technology has a ways to go.

We are in a transitional era.

Who is making the power transition, and why?

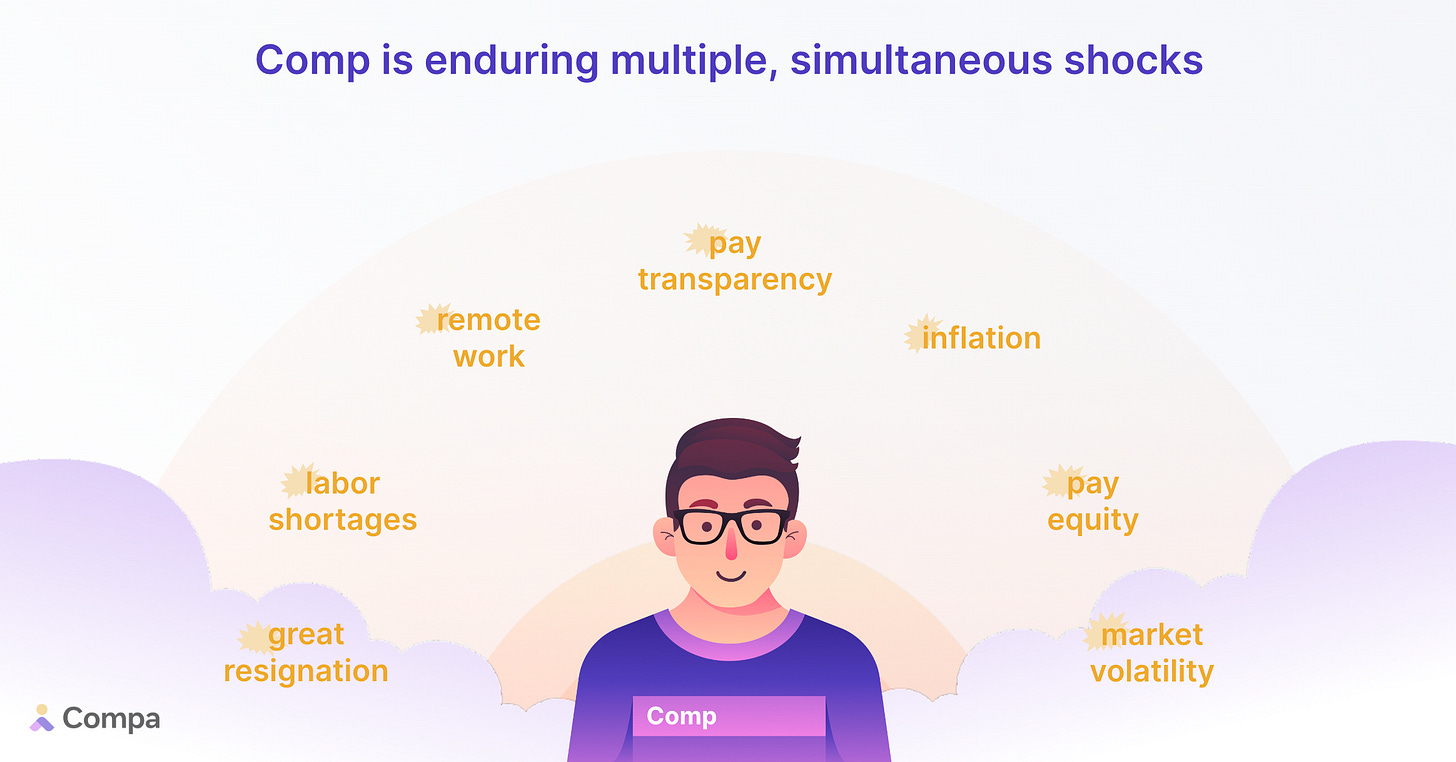

Over the past two years, total rewards teams have endured multiple, simultaneous shocks:

Remote work

Great resignation

Labor shortages

Pay equity

Inflation

Pay transparency

Market volatility (and mass layoffs)

When talent markets are volatile, the importance of real-time data grows.

These shocks are most acutely felt in knowledge worker industries like life sciences, healthcare, financial services, and technology. These are the teams in search of something different.

And they aren’t throwing out everything and starting over.

They’re experimenting.

Just like resilient power grids rely on a mix of energy sources to balance base loads and peak loads, innovative total rewards teams are adding new data sources to surveys to address new challenges.

Most comp leaders agree that real-time data has a ways to go before we can fully swap out surveys.

But just because the technology “isn’t there yet” doesn’t mean it’s not the future.

Like the transition away from fossil fuels towards renewables, the transition to real-time data is needed and inevitable.

P.S. — Going off-grid…

Bonus content: we talked about fossil fuels and renewables, but what about going off-grid?

Yes, we can extend the metaphor here, too.

The answer is to listen to your recruiters and watch attrition: candidate expectations, competing offers, application traffic, win rates, and exit surveys. With enough consistency and scale, clear patterns emerge.

Think it couldn’t work?

Some of the most innovative comp teams at the most progressive companies in the world are already using “off-grid” data sources alongside surveys and real-time data.

What a time to be alive.

Peer Group is a newsletter for comp leaders navigating the new era of pay transparency! If you want to share my newsletter, you can forward this email to your colleagues and fellow comp leaders.

Want more polls and insights about pay transparency?

Subscribe by hitting the button below.